The site navigation utilizes arrow, enter, escape, and space bar key commands. Left and right arrows move across top level links and expand / close menus in sub levels. Up and Down arrows will open main level menus and toggle through sub tier links. Enter and space open menus and escape closes them as well. Tab will move on to the next part of the site rather than go through menu items.

Credit Score Monitoring

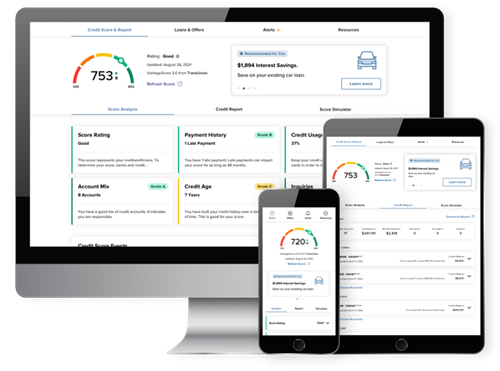

Free Access to Your Credit Report & Score on Home Banking

Master your credit standing with no purchase or credit card required.

Take greater control of your financial life with SavvyMoney, Cyprus Credit Union’s free credit-tracking tool. This complimentary service provides 24/7 access to your TransUnion credit score and report as well as credit monitoring alerts, financial education resources, and tips on how to improve your credit — all easily accessible on Home Banking and the Cyprus CU Mobile Banking app.

SavvyMoney is available to Cyprus members with checking accounts. Want to see your credit score but don’t have a checking account? Open your Dream Rewards Checking account today!

Get Started in Home Banking

![]()

Credit Confidence

Never miss a thing with real-time security updates any time your credit file changes.

![]()

Daily Score Updates

Empower your financial decisions by accessing your score anytime anywhere.

![]()

Money-Saving Offers

Turn your credit into an engine for financial achievement with personalized savings offers.

Staying up to date on your credit is easy with these great SavvyMoney tools.

Credit Score

Access your regularly updated TransUnion credit score. Use the Analysis section to find out what influences your score and how to improve your rating.

Credit Report

View a summary of your credit accounts and their balances.

Score Simulator

See how your credit activities could impact your score in the future.

Credit Monitoring

Have peace of mind knowing your credit report is monitored daily. You’ll be alerted of any key changes on your report.

Credit Disputes

File a dispute directly through TransUnion to address any errors or inconsistencies in your credit report.

FAQs

See what others like you have asked about their credit scores and reports.

Your Money Tool

The Your Money section provides tips for increasing your credit score and optimizing your financial health.

It's Easy to Get Started!

Accessing SavvyMoney

SavvyMoney is conveniently available on Home Banking and the Cyprus CU Mobile Banking app. Follow the steps below to get started!

- Log in to your Home or Mobile Banking account.

- Go to the menu and select Services.

- Choose the Credit Score and Report option.

Don’t have the app? Search for Cyprus CU Mobile Banking on Apple’s App Store or Google Play.

Frequently Asked Questions

The Credit Union does not have any responsibility or control over any of these external web sites, their content or their privacy policies. We do not endorse or make any representations about third-party external web sites, including any information, products, materials or results that may be obtained from using them.

If you decide to access any of the linked third-party web sites, you do so entirely at your own risk. You are encouraged to review the privacy notice for each linked web site.

Please do not send any personal financial information via Email.

E-mail transmission cannot be guaranteed to be secure and information

could be intercepted, lost, or contain viruses.