The site navigation utilizes arrow, enter, escape, and space bar key commands. Left and right arrows move across top level links and expand / close menus in sub levels. Up and Down arrows will open main level menus and toggle through sub tier links. Enter and space open menus and escape closes them as well. Tab will move on to the next part of the site rather than go through menu items.

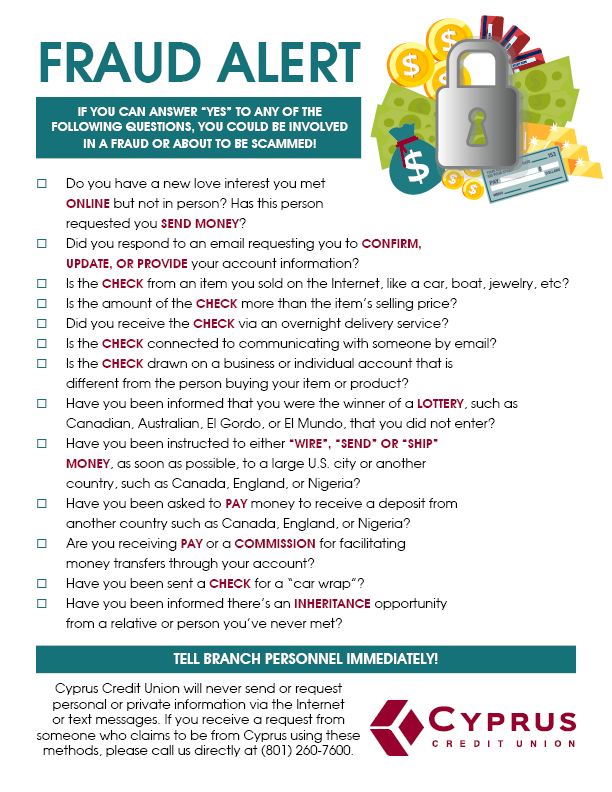

Fraud Alerts & Prevention

Types of Fraud

Identity Theft

Online Scams

Fraud Prevention Tips

From the Blog:

Recognizing Signs of Fraud

As continues to evolve, so too do potential avenues scammers can take to steal your private information. But with a few simple steps, you can ensure you stay safe. Here are some signs of fraud you can spot to avoid becoming a victim. Read more...

How To Prevent Fraud

Technology has helped make the world more accessible than ever before. Unfortunately, it's also helped fraudsters find new, inventive ways to scam people. Here are a few things you can do today to secure your financial information from potential fraud. Read More...

Identity Theft

Identity Theft Resources

Data Breaches

Along with all the conveniences of technology come its disadvantages. Data breaches are one such disadvantage. When you've been a part of a data breach, it can feel as though your privacy has been violated--and rightfully so. This is because data breaches can open the door to identity theft.

Identity theft can occur when an individual obtains your personal information, such as a social security number, date of birth, address, and financial account numbers. Once the information is obtained, the thieves will assume or take on your identity. This will allow them to make purchases or obtain lines of credit under your name.

What Is a Data Breach?

A data breach occurs when someone accesses information at an organization or company without being authorized to do so. The perpetrator can access and steal information stored on the targeted institution's computer systems. Once that happens, they can use that information themselves or sell it to others, leading to identity theft.

Identity Theft & Data Breach Resources

If you've been a victim of a data breach and/or identity theft, or if you'd like to learn about how to protect yourself, here are some great resources you can go to for further instruction.• U.S. Federal Trade Commission: http://www.ftc.gov or http://www.identitytheft.gov

• U.S. Department of Justice: http://www.justice.gov

Credit Bureau Contact Details

- Free Annual Credit Report

www.annualcreditreport.com

- Equifax

800-525-6285 (Fraud Hotline)

800-685-1111 (Order a Report)

www.equifax.com

- Experian

888-397-3742 (Fraud Hotline)

888-397-3742 (Order a Report)

www.experian.com

- TransUnion

800-680-7289 (Fraud Hotline)

800-916-8800 (Order a Report)

www.transunion.com*Credit bureaus must provide free copies of credit reports to victims of identity theft.

Phishing

Member security is very important to us. As such, please be advised that members may receive phone calls from scammers posing as Cyprus Credit Union employees. If you receive such a call, please note that we will never contact you to ask for any personal information, including but not limited to:

- Account Number

- Personal identification numbers (PINs)

- Date of Birth

- Credit Card Details

- Home Banking login credentials

- Secure Access Codes

If you receive a call asking for this information, please be aware this is a possible fraud situation. To verify, please Cyprus Credit Union's Contact Center at 801-260-7600 option 4 before divulging any personal information. As an extra precaution, we suggest that members verify their Home Banking contact information is correct and all passwords are frequently changed.

If you supplied information via email, phone, social media, or other means to someone you suspect was scamming you, please contact us at 801-260-7600 option 4 immediately.

Online & Social Media Scams

Social Media Scams

You’ve probably seen them before—those get-to-know-your-friends-better surveys that go around social media. They can be a fun way to get to know your acquaintances better while telling a little bit about yourself, too. But is it a good idea to participate?

Some of these surveys may have simply been created as an entertaining activity. Others, however, may be devised as a way to get personal information from you. For instance, take a look at this sample survey below. It’s similar to those already circulating on social media.

Sample Survey

LET’S GET TO KNOW EACH OTHER! Thought this quiz would be fun to do together. Copy the text and paste it in the comments section with your answers. I’m curious to see who knows how to drive a stick shift!

1. What was your first car?

2. What year did you graduate high school?

3. What was the first foreign country you visited?

4. Can you drive a stick shift?

5. What is your zodiac sign?

6. How many languages do you speak?

7. What is your favorite vacation spot?

8. How old are you?

9. What is your mother’s maiden name?

10. How many tattoos do you have?

11. What was your 1st grade teacher’s name?

12. Are you a dog person or a cat person?

13. Do you have any kids?

Why It Matters

While some of these questions may seem harmless, others can lead you to provide valuable knowledge to scammers. What’s more, the answers you provide to the questions can be used in conjunction with information you’ve already made public on social media. This might include where you work, the high school you graduated from, your marital status and family members, along with your favorite movies, TV series, and books. Not only can this information provide clues to what you might use for your passwords, but they can also supply answers to security questions you may have set up on your online accounts. Many people use security questions asking them about their mothers’ maiden names, their favorite vacation spots, the names of favorite school teachers, the names of the streets they grew up on, and more.

The same thing can happen when you take online quizzes for fun. These lighthearted quizzes tell you to participate to find out which cartoon character you are, for example. Another might promise to tell you which city you should live in. Some of these quizzes, however, may require that you hand over access to your social media account first. Others may ask questions similar to those in the sample survey above.

Now, keep in mind that if you see a friend share one of these quizzes or surveys on line, it does not mean they are trying to trick you into giving them information. The goal of the scammers who create suspicious posts such as these is to get them circulating throughout social media platforms. Once one unsuspecting person participates, they will share it with their friends. Then, those friends will do the same. The scammers can track how their posts have been spreading and collect information from everyone who has participated.

Takeaway

A good rule of thumb is this: If you're asked to provide any specific information about yourself on a social media post or by someone you don’t know, do not provide it. What might appear to be a fun game could actually be backed by ulterior motives. Social media can be a wonderful tool to keep in touch with family and friends, coordinate events, or share news and ideas. Knowing what to watch out for can help you continue using it securely.

Mobile Payment Apps

Please be aware that payment apps such as Venmo, Zelle, Cash App, etc. post as a debit transaction on your account. This means we are unable to process disputes on these charges. Use caution when sending funds to someone you don’t know when using these apps.

To learn more about common scams or to file a complaint, please visit the Utah Department of Commerce website or IC3.gov

Amazon Scams

In recent years, Amazon has become one of the most popular online shopping sites in the world. As a result of this, it has also become a popular destination for potential fraudsters. Here are some common scams that you should be on the outlook for whenever you shop on Amazon.

Spoof Emails

People can mimic emails from Amazon in order to get you to click on links that can damage your phone or computer. Additionally, Amazon will never reach out to you via email for your personal information. If you receive an email asking for your password, address, credit card info, etc., disregard and contact Amazon customer service directly.

Gift Cards

Don’t use Amazon gift cards as a method of payment, both on and off of Amazon. Once you share any details from the card with another person, there isn’t anything Amazon can do once the funds are spent.

Other Payment Methods

If a product you purchase on Amazon tries to direct you to another website to make your payment, this is a red flag. If other forms of payment, such as a wire transfer or cash, are requested by the seller, they are not a legitimate Amazon partner.

Brushing

This is the act in which a seller orders their own product (or a stand-in) and then ships it somewhere random in order to leave a positive review. This helps improves the likelihood that someone else will see the product and order it. On the other side, the random person who received the package is now stuck with an Amazon purchase that they didn’t make. If this happens to you, reach out to Amazon to report it

Targeted Fraud

Elder Fraud

What to Know About Elder Fraud

The elderly population is growing. Along with that growth, elder fraud has become increasingly visible. Elder fraud is the act of seeking financial gain by scamming a specific group of people: senior citizens. Here is some information on what puts senior citizens at greater risk for fraud, what you can do to protect yourself and your loved ones, and how to report elder fraud.

Why are seniors at risk?

Although anyone can fall victim to a scam, there are a few factors which make elderly individuals prime targets. They are more likely to have money saved for retirement or to give as inheritance. Scammers also find senior citizens to be more trusting. Finally, seniors are less likely to report fraud because they may be embarrassed or simply not know how to get help. They may also be concerned that their family members will not trust them to independently live or handle their finances.

How to Protect Yourself

- Never give out personal or banking information to anyone you do not know or trust.

- Be careful when answering phone calls from phone numbers you don’t recognize.

- Be cautious if you decide to respond to emails or messages from people you don’t know.

- Pay attention to how you feel. Does the person you are speaking with make you feel afraid or pressured to give out personal or financial information? If so, stop and don’t be afraid to call the police or someone you trust.

- If someone calls claiming to be from the IRS or other government agency, keep in mind that government offices will usually contact you by mail. They should not ask you to give out personal or banking information over the phone.

- Hang up when in doubt.

How to report fraud

To report elder fraud—or if you suspect elder fraud may be taking place—you can do one of the following:

- Call the National Elder Fraud Hotline at 833-372-8311 (or 833-FRAUD-11).

- Reach out to the nearest FBI field office. Click here for more information.

- File a report to the FBI’s Internet Crime Complaint Center by clicking here.

- Submit an online tip to the FBI by clicking here.

If you have had money taken from your bank account or suspect your account is being targeted by scammers, you should also reach out to your financial institution for assistance as soon as possible.

Student Loan Scams

Every year, hundreds of thousands of students apply for some type of financial aid. Because of these numbers, there are fraudsters just waiting to take advantage of the situation. Here are some signs to look out for that you may be falling victim to a student loan scam.

FAFSA Form Fees

Filling out a FAFSA form is free and easy. If you do need help, many organizations offer free assistance including the FAFSA website, the Federal Student Aid Information Center, and the financial aid office from the school you are thinking of or currently attending. If a company requires fees to fill out these forms, it’s suggested you look elsewhere.

Immediate Relief

There are many options out there for legitimate public student loan relief. However, many of these options take time in order to qualify. If a company offers immediate relief in exchange for a fee, this may be a sign they are fraudulent.

Private Information

If a company reaches out over the phone or via email asking for confidential information, such as your social security number, this is not a normal practice. Most companies will use mail or secured messaging within their site to reach out to you.

Pressure Pitch

Choosing the best loan option for you can be a lengthy process. If you find yourself in a situation where pressure is being placed on you to make an immediate decision, it’s probably best to search out other options. Many fraudsters use this approach that you need to make a decision quickly so that you won’t have time to do your due diligence.

Keeping these signs in mind as you apply for financial aid will help save you from student loan scams that will cost you time and money.

Job & Unemployment Insurance Scams

Unemployment Insurance Fraud

Unemployment scams often become more common during times of economic downturn. With these types of scams, a fraudster claims unemployment benefits using a stolen identity. The victim may not even realize their identity has been stolen until they try filing for unemployment benefits themselves or they receive a notice from the state that an application for unemployment benefits has been filed under their name. Be wary of phone calls, text messages, letters, websites, or emails that require you to provide your personal information or other sensitive information, especially birth dates and social security numbers. Be cautious opening attachments or clicking on embedded links within emails, especially from an unknown sender.

Job Scams

Job scams target those looking for employment. The Federal Trade Commission (FTC) warns that "scammers advertise jobs the same way legitimate employers do — online (in ads, on job sites, and social media), in newspapers, and sometimes on TV and radio. They promise you a job, but what they want is your money and your personal information" (ftc.gov). You can even be targeted by job scams on well-known employment websites. If you've uploaded your resume anywhere online, its possible that a scammer could come across it. They can then use the information in your resume to invent a "dream job" to offer you.

Be suspicious of job offers that include any of the following:

- Too Good to Be True

Scammers will use certain phrases to pique the interest of potential victims, such as "unlimited earning potential" or "earn money fast." They may also offer an usually high salary. Do some research on similar job positions and compare their average salaries to the one you're being offered. You should also be careful if you receive an offer for a position that you didn't apply for.

- Required Payments

If a job listing or offer requires some form of payment from the job seeker, this is likely a sign of a scam. This also includes if a company asks for your bank or credit card information. Additionally, if you receive a paycheck from a company and are asked to deposit it and then send some back, this is also a scam. By the time your financial institution realizes it's a bad check, the money you sent back will be long gone.

- Quick Offers

If you receive an unsolicited job offer or are offered employment after an unusual interview process (such as an interview over social media or email), you should approach with caution. Sometimes, even a quick search on Google or the Better Business Bureau (BBB) can help you know if the company offering you a job is legitimate.

- Unusual Emails

If you receive a job offer full of spelling, grammar, and punctuation errors, this could be a sign of a scam. If the tone of an email feels strange, such as being unprofessional or asking for too much personal information right off the bat, this may also be a red flag.

Small Business Administration Loan Fraud

With new loan options available for small business owners, many fraudsters are using this opportunity to take advantage of an already vulnerable small businesses. Using the Small Business Administration name, the fraudster will contact the owner with an offer for a small business loan. The SBA never makes first contact, all loan inquiries need to be initiated by the owner. If you are being asked to pay a fee upfront to receive a loan, this may also be a red flag of fraud. For more information, click HERE.

Robocall Scams

As with many people, you may have seen an uptick in the amount of robocalls you receive. While some of these are legitimate, you may also receive some spam. Here is what you should do to deal with robocalls.

Don't Speak

Once you realize it’s a robocall, hang up immediately and don’t say anything. The goal with a robocall scam is to extract as much information about you as possible, so the less you say, the better.

Don't Press Any Buttons

Some robocalls may ask you to follow commands by asking you to push buttons. This is a tactic to prove the number belongs to a human being and your number may be sold and result in even more spam/robocalls.

Don't Call Back

If the robocall leaves a voicemail asking you to call back, even if you think it’s a legitimate message, such as the pharmacy calling to let you know they have a question about a prescription, find the number and call them back directly yourself.

Report Suspicious Calls

If possible, report the number that called you so it can be marked as spam. Calls can be reported to U.S. Federal Trade Commission (FTC) online or by calling 1-877-382-4357.

Money Mules

What is a Money Mule?

A money mule is someone who transfers and moves dirty money for someone else. As a reminder, “dirty” money is money that has been acquired illegally while “clean” money has been earned legally.

Here's a basic example of how money mules help criminals launder money:

1. First, a criminal group acquires dirty money. They want to create “layers” between themselves and the funds. This can make it harder to track down where the money came from if the criminal’s bank account is ever investigated by their financial institution or law enforcement.

2. To create a “layer,” the criminals transfer some of the dirty money from one of their accounts to another person (we’ll call him John Doe). The criminals make it look like the funds transfer is for something legitimate, such as a direct deposit from an employer.

3. John Doe then transfers the money from his bank account into another account which is controlled by the criminals. Since John Doe has just moved dirty money on behalf of the criminals, he has become a money mule. John Doe can make it look like the money he sent the criminals was for a legitimate purpose, such as rent.

Types of Money Mules

Some money mules are aware they are transferring dirty money for criminals. They may have been offered a cut of the money in exchange for moving the funds or—in extreme situations—threated by the criminals to do as they say. In other cases, one of the criminals themselves may act as the money mule within their own group.

Not all money mules are aware they are assisting criminals. They may have been scammed into helping.

Common Scams

There are different ways you can be tricked into transferring dirty money for someone else. Romance scams are one such method. In an online romance scam, a criminal uses a dating website/app or social media to establish a close connection with you. Once they have convinced you that they are in love, they exploit that trust and begin asking you to do favors for them, such as receiving money and forwarding the funds to someone else.

Another common method is for criminals to send you unsolicited job offers promising easy money with little to no effort on your part. This can include secret shopper opportunities or jobs that let you work from home. You may be asked to open a new bank account so you can receive and transfer funds on behalf of your new “employer.” They may ask you to open the new account under either your name or the name of the fake business.

How to Protect Yourself

If you are ever transferring money on behalf of someone else, there's a chance you could be a money mule. Acting as a money mule can lead to your bank account being closed, your personal information being exposed, damage to your credit and finances, and—in some cases—legal consequences. Here are some ways you can prevent yourself from becoming an unsuspecting money mule:

- Be suspicious of unsolicited job offers that you receive by mail, email, or social media. A legitimate employer will not ask you to open a new bank account or use your own account to carry out transfers for them.

- If you are interested in following through with an unsolicited job offer, do some research first. At very least, check online to see if the company reaching out to you is legitimate and trustworthy.

- While anyone can be targeted as a potential money mule, be especially careful if you are using dating websites, looking for a job, or if you’re a student. These groups are especially at risk.

- Be cautious when meeting people on social media or dating websites/apps. If someone asks you to use your bank account to receive or forward money for them, that is a red flag.

- Never give your banking information to someone you don’t trust or know well. This includes your account number and login information for online banking.

- If you ever suspect you are being used as a money mule, follow these three initial steps:

- Cease communicating with the suspected criminal(s). Don’t do any further transfers for them.

- Reach out to your financial institution so they can protect your bank account.

- Contact law enforcement for assistance and further instructions. You can even click HERE to find the contact information for the FBI field office over your area.

The Credit Union does not have any responsibility or control over any of these external web sites, their content or their privacy policies. We do not endorse or make any representations about third-party external web sites, including any information, products, materials or results that may be obtained from using them.

If you decide to access any of the linked third-party web sites, you do so entirely at your own risk. You are encouraged to review the privacy notice for each linked web site.

Please do not send any personal financial information via Email.

E-mail transmission cannot be guaranteed to be secure and information

could be intercepted, lost, or contain viruses.